To understand inflation better I think it’s important to study the nature of money.

So, what really IS money?

It’s almost weird. We all use and know what is money, or we think so. Money was born due to the necessity of having an agreed and trusted medium of exchange. Before money, trade was based on the direct exchange of goods on a “coincidence of wants” structure. This means that if I produced cereal and you produced apples, we could exchange cereal for apples at a negotiated ratio. This was obviously not very efficient and a 3rd widely accepted good was needed. It had to be stable in its value, transportable, and easily exchangeable.

So, the more mature and predominant versions of money were based on metals. Gold was the most predominant one. As wasn’t very efficient to carry gold on you, banks started to be born. Banks kept your gold and gave you notes that certified that you could exchange those notes for gold in the institution. So it became more user-friendly to have the paper notes on you and just exchange those for goods. This was the beginning of paper money, backed by gold.

Going on from here, Governments started to create centralized currencies backed by gold. This means that the central banks in order to print more money had to increase their reserves in gold. And it worked fine for a while. In 1971 (only 50 years ago!), the current reserve currency, the American dollar (USD), broke the gold standard.

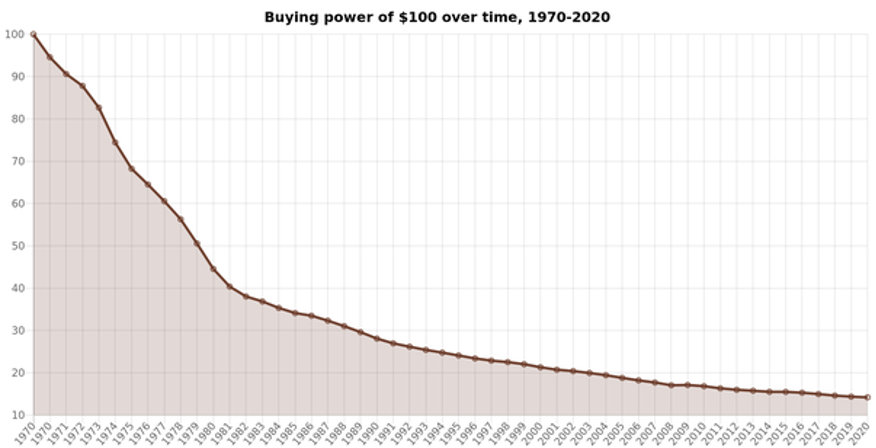

This is the mind-blowing evolution of the buying power of a dollar since it moved away from the gold standard and it became a fiat currency.

So, the dollar has collapsed from 6 to 1 on today’s dollars. That means that has fallen almost a 90%. This clearly shows the nature of the system in which we are. An inflationary system by design.

What tells you this image? To me is very clear: as soon as you get fiat money in your hand, you have to spend it or invest it, but by just holding it you lose value every second.

Inflation is part of the current system. Controlled inflation, around 1-2%, is beneficial as it incentives the players in the economy to move forward and don’t wait to make investments and therefore helps productivity and innovation. We have to live with it.

But why the monetary system is inflationary? In the great book of Ray Dalio: How the economic machine works, you can find more answers. You can also find a 30 min documentary of this book, narrated by Dalio itself (video at the end of the page).

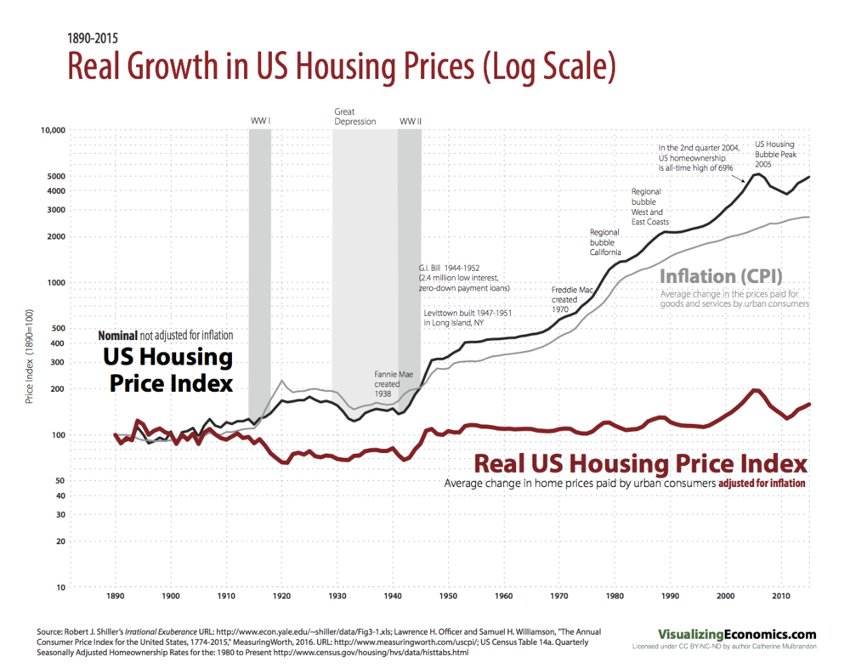

So currently we are in an inflationary system by default with a severe inflation peak. But how behaves real estate in this environment? Is it a good option to invest in real estate now? Let’s check some data:

It seems that the intrinsic value is pretty constant over time. With some moves up and down on the economic cycles but with a steady move up since WWII. When we see the correlation with the CPI, we can safely say that real estate is an inflation-resistant asset.